Automating NAVPS Calculations for a Leading Investment Fund Administrator

Jan Kotrč

Managing over 200 investment funds means calculating the Net Asset Value per Share (NAVPS) for each fund. This process requires accuracy and timely delivery. Every NAVPS figure supports investor reporting, regulatory compliance, and internal decision-making. However, the previous method was slow and very manual. Teams worked with endless spreadsheets, exchanged numerous emails, and reconciled data from different systems by hand. With hundreds of calculations to process separately, even small inefficiencies caused big delays. This dependence on manual work created bottlenecks, complicated collaboration, and increased the risk of inconsistencies and missed deadlines.

Challenges

Each fund has its own unique rules for calculating NAVPS. Accountants spent a lot of time gathering and validating data from multiple systems, often repeating similar steps across hundreds of funds, but with slight variations each time. Each calculation needed custom logic, manual checks, cross-referencing, and reconciliation, which slowed down the process and raised the chance of human error. Leadership lacked a clear overview of calculation statuses across all funds, making reporting cycles unpredictable and stressful. Missing deadlines, last-minute changes, and repeated corrections became the norm. Meanwhile, pressure from investors and regulators made accuracy and transparency even more important, adding more strain on finance teams.

Solution

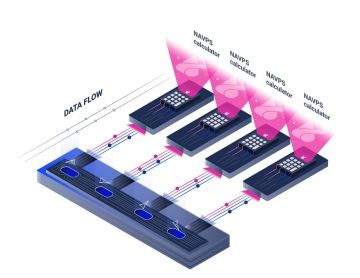

To tackle these challenges, we created an automation layer that fits seamlessly into the existing setup. It requires no system changes or interruptions to current workflows. This solution automatically gathers data from multiple sources and calculates the NAVPS based on each fund's specific rules with consistent accuracy. We verify the results by comparing them to the client’s previously calculated NAVPS values. The results blend into existing systems without users needing to navigate a new interface.

With over 200 investment funds, each requires unique logic for NAVPS calculation. Our flexible approach works without disrupting the current infrastructure, which would be impossible with a traditional monolithic system. Thanks to BitSwan's modular architecture, the NAVPS project consists of a set of distinct automations, each representing a clearly defined task that even non-technical stakeholders can grasp. Analysts receive ready-to-use data from connected systems, allowing them to focus on refining fund-specific logic rather than extracting and preparing data. The outcome is a solution that’s easy to maintain, scale, and explain.

Results

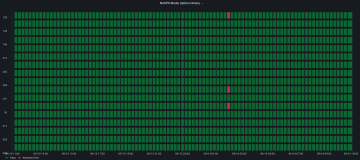

Automation changed how the client handles NAVPS calculations. Manual work dropped significantly, which allowed finance teams to save time and reduce stress. Automated data validation ensured consistency with historical results and lowered the risk of future errors. This increased confidence in reporting accuracy. Face-to-face validation with the finance department uncovered past discrepancies in the client’s historical data for certain calculation periods. Some of these discrepancies were due to human error and needed explanation.

Reporting cycles became faster, more predictable, and easier to manage. This led to timely updates for investors and smoother compliance processes. With better visibility into each step of the calculation process, the organization gained control and transparency. This improved collaboration between accounting, operations, and management teams.

Freed from repetitive and error-prone manual tasks, teams could focus on higher-value activities like forecasting, fund performance analysis, and strategic planning.

Takeaway

By automating NAVPS calculations for each fund and generating official calculation reports in PDF, the fund administrator transformed a slow, error-prone process into a smooth, clear, and dependable workflow. This improved compliance standards, saved a lot of time, and made it easy to scale the process with each new fund. Consequently, the client gained the clarity and flexibility necessary to make smarter, data-driven decisions throughout the organization.